Glimpsing into 2023

Here we go again

Almost exactly one year ago, I published a piece called “Top Risk for 2022.” I admit these types of articles are generally a waste of time since most people - including myself - are not great at predicting the future. And as fun as it is to write this stuff, most of the risks I mentioned actually ended up not important. But one risk I highlighted ended up actually ended up being critical for 2022:

Inflation became the dominant story this past year for markets. So … the question now is: will this continue to be the dominant theme for 2023?

Let’s take a look at where we’re at now, and then where we’re headed.

Currently, inflation rates are still high around the world, from the U.S. to the E.U. to Japan. However, pressures are abating somewhat, and particularly in the U.S. Remember that for inflation risks to truly abate, we need to see inflation coming down around the world. So the question markets will be looking at next is: will this abatement trend continue? How quickly will it abate? And will it be pervasive around the world? Just looking at the data alone, we are not out of the woods. Inflation still looks high in Europe and in Japan. Moreover, there is no discernible reversal. We’ll need a few more months before we can say with certainty that inflation is on the mend.

The dollar has reversed its steady appreciation, reflecting slowing inflation expectations in the U.S. relative to the rest of the world. The dollar’s appreciation has notably reversed against major G-10 currencies, meaning Americans looking to travel abroad aren’t going to get the same deals as before. Currency markets follow interest rate differentials, so what this means is currency markets are predicting the U.S. Federal Reserve will curb its interest rate hikes in the coming months faster than other central banks around the world.

Likewise, we see U.S. Treasury yields broadly pausing their steady march upwards. The yield curve still remains highly inverted, which suggests a recession is still being priced in within the next year or so. Currently, the 20-year yield is at 3.51 percent, while the 1-year yield is at 4.65 percent and the 3-year rate is at 4.28 percent. As I’ve noted before, yields don’t do this - longer-dated yields are nearly always higher than shorter-dated ones - so the market remains highly distorted. The market is very much expecting a recession, and so any data that shows we’re headed in this direction will likely be met with a market positive reaction.

Meanwhile, the rapid increase in commodity prices associated with covid has completely evaporated. Not only have oil, gas, copper, and lumber prices plummeted since multi-year highs earlier this year, but even food prices such as wheat and soybeans have come back down to earth. This suggests that inflation pressures will nearly have to come further down in the months ahead, but also that commodity prices - like the markets above - are firmly pricing in recession risks. Meanwhile, the fact that prices at supermarkets remain through the roof even while raw goods is in the tank suggests collusion among U.S. firms continues.

Despite all this anticipation of a recession, we still don’t see any clear economic signals that we’re actually approaching one. The typical indicator of a recession is rising unemployment, but looking at the numbers, we aren’t even close. In fact, unemployment is at its lowest level in nearly two decades (!). This continues to pose a conundrum to markets, and is why markets seem to do poorly when unemployment numbers actually print “healthy.” Medicine is what’s needed for today’s broken financial markets, and yet the economy stubbornly refuses to accept it.

Some are suggesting that we could see a recession with very little unemployment in 2023. Bank of America CEO Brian Moynihan on Sunday said he expects the U.S. economy to contract by “just 1%” for the first three quarters of 2023, then return to positive growth. This contrasts with other U.S. banks, who are predicting a more severe recession in the year ahead. But my inclination is to side with my former employer. Maybe a recession is imminent but also maybe it won’t be as bad as everyone fears. Still, nearly everyone is expecting something: according to a survey in October, 98 percent of corporate leaders preparing for a recession over the next 12-18 months.

What are some other risks out there? In my eyes, there are still quite a few:

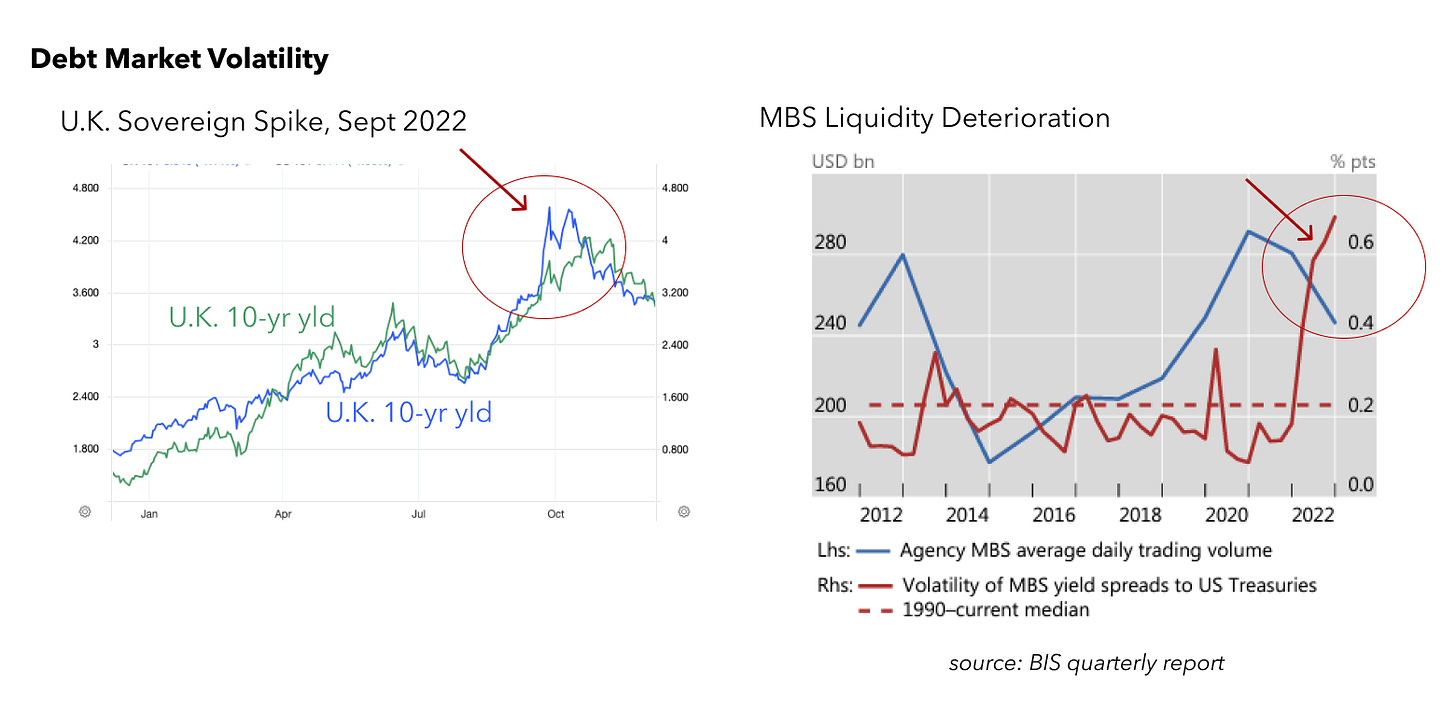

Liquidity problems in debt markets. We already saw the U.K. sovereign market blow up after the government announced dramatic tax cuts along with energy subsidies this past year. The Bank of International Settlements also (BIS) published a report recently concerning global market conditions and the risks of more small investors and leveraged hedge funds entering the MBS market. With rates being so volatile and markets expecting the next shoe to drop, expect to see more such volatility and possible blow-ups in the coming months, particularly as firms and governments will face a) reduced revenues on the back of b) higher interest rates, which historically has been a very bad combination for highly indebted entitites.

Geopolitical risks. The last year has also given us considerable geopolitical instability to chew on. First, Russia invaded Ukraine. Russia and China issued a joint statement opposing further NATO expansion and pledged to cooperate on a range of issues. China conducted its largest military exercise ever around Taiwan in response to Pelosi’s visit. Israel’s far-right won a 64-seat majority, allowing Prime Minister Netanyahu to win a third term. Beijing’s “zero-covid” policy finally sparked student and civilian unrest around the country. These were key market-moving risks impacting major global powers, people. The best we can hope for is that the Russia-Ukaine crisis reverts to a low boil, that the CCP does not retaliate against civilians who protested, and that cooler heads prevail in Israel’s legislative undertakings. But given how 2022 went, if you believe all that, I got a bridge to sell you in South Sudan.

China’s covid policies lead it into a pit of despair. The social contract of China’s government has always been that the government stays in power without contest, but that the people receive tangible economic benefits and are kept safe. The CCP is now not delivering on either of these fronts. The Chinese economy is in shambles, and now that they’ve been forced to open up due to student demands, it’s highly likely that covid rates will spiral skyward. How will China’s society react? China’s social stability risks will remain for 2023.

Disclaimer: BubbleCatcher is published as an information service for subscribers, and it includes opinions as to forecasts on the global economy and its impact on securities linked to economic activity. The publishers of BubbleCatcher are not brokers or investment advisers, and they do not provide investment advice or recommendations directed to any particular subscriber or in view of the particular circumstances of any particular person. BubbleCatcher does NOT receive compensation from any of the companies featured in our articles. At various times, the publisher of BubbleCatcher may own, buy or sell the securities discussed for purposes of investment or trading. BubbleCatcher and its publishers, owners, and agents are not liable for any losses or damages, monetary or otherwise, that result from the content of BubbleCatcher. Past results are not necessarily indicative of future performance. The information contained on BubbleCatcher is provided for general informational purposes as a convenience to the subscribers of BubbleCatcher. The materials are not a substitute for obtaining professional advice from a qualified person, firm, or corporation. Consult the appropriate professional advisor for more complete and current information. BubbleCatcher makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that BubbleCatcher endorses, sponsors, promotes, or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites unless expressly stated.