First, let’s consider some of the positives for 2022. The biggest is the Infrastructure Investment and Jobs Act along with the Build Back Better plans will inject $2.4 trillion in new spending on things like transportation, technology, broadband, clean energy. This will likely push up growth next year to 4% or more for 2022 as well as help boost employment and productivity.

Corporate balance sheets are also generally flush with cash while households still see cash surpluses (although these reserves are beginning to dwindle). This all spells good news for markets because it means: a) corporate demand should remain strong, b) stock buybacks will increase; c) acquisitions should increase.

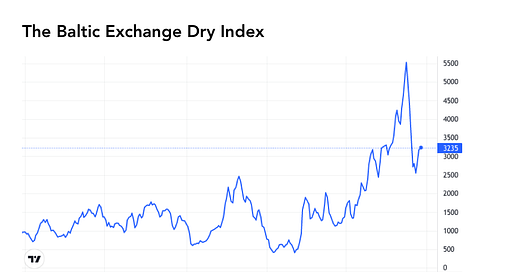

Also, shipping costs are finally beginning to improve. The Baltic Dry Index, which measures dry bulk shipping costs, has fallen 50 percent from just two months ago. There has also been material improvement in clearing bottlenecks at ports, which is net-positive for reducing inflation pressures.

However, there are still numerous risks to the market these days, and a good investor always needs to be psychologically equipped for what might be headed down the turnpike. Here are a few risks:

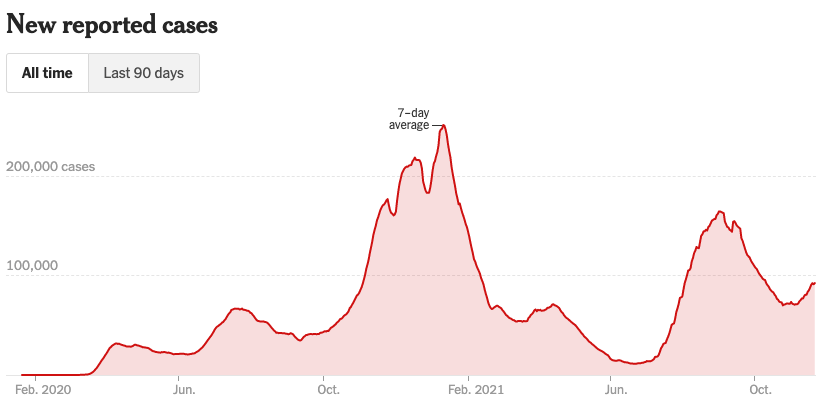

Another covid variant comes to the fore. As much as we’d like this disease to be behind us, it has proven time and again that it will not go away quietly. Although the Omnicron variant does not seem to have serious symptoms, we cannot say for sure if more deadly variants may be coming down the road. As long as this disease is around, global growth prospects will be curtailed, and the logistics problems at the world’s ports will linger. This means inflation pressures will continue, parents will be kept home due to homeschooling, the labor supply will remain constricted, labor costs will rise, and interest rate hikes will be more likely. All of which would weigh on market sentiment.

Inflation rises or remains stubbornly high. Rising inflation likely remains the biggest risk for 2022 so far, particularly if growth slows. We already see it in our everyday shopping from food to gas to Christmas gifts. If inflation continues, the Fed will have to shift forward its timetable for raising rates. Rising rates will negatively impact high-growth investments (i.e. tech stocks), potentially in a dramatic fashion, and put a damper on gains we’ve seen on tech. More likely, we’re likely to see days, weeks, or even months where interest-sensitive stocks - i.e. tech - remain stagnant or decline as investors digest the new higher-rate environment. This could, however, prove beneficial for commodities, which already have had a good year and which tend to do well when inflation is high. Current expectations suggest the Fed will raise rates by June, with further incremental hikes in subsequent quarters.

U.S.-China tensions lead to further grey-zone tensions or conflict. Currently, the chances of an all-out conflict between the U.S. and China are still low. But at the current trajectory, the chances of a conflict sometime in the future continue to tick slowly higher, particularly over China’s desire to reclaim Taiwan. It is unlikely that China would risk any moves on Taiwan this year due to the Beijing Winter Olympics in early 2022 and the Party Congress in late 2022. But beyond that, the future looks concerning. There are many signs of late - in President Xi’s speeches, military maneuvers, efforts to de-couple China’s economy from the west, etc - in his goal of reclaiming Taiwan sometime soon. Many Mainland Chinese have for decades dreamed of a leader that would dare reclaim Taiwan by force, which would forever cement his name in China’s history books as finally uniting Chinese territory (a goal sought by Chinese leaders for thousands of years). Moreover, after decades of double-digit growth, China’s economy is stalling, and Xi will be under more pressure to perform on his goals to his people, particularly given he literally will be re-appointing himself in late 2022. Expect more tensions between the U.S. and Chinese leaders for 2022, some of which will filter into markets.

Cyber security risks will increase. Covid caused companies to shift to technology in an unprecedented way. This means these companies are now even more prone to costly cyberattacks. This, along with elevated geopolitical tensions between the U.S. versus Russia, North Korea and China means cybersecurity will be a key defensive play. Cyber security investments have barely outperformed the Nasdaq over the past year (see below), but we should expect this portfolio to be volatile. Long-term, prospects look good: the price paid to address a cyberattack has increased, with the average cost of data breaches now reaching $9.05 million, up 5 percent annually. Moreover, victims now face an average of 23 days of downtime to repair damage after a ransomware attack - an expensive proposition for a company increasing reliant on online earnings. Meanwhile, companies selling compelling cybersecurity solutions should continue to benefit in 2022.

Chinese economic slowdown. China’s economy is expected to grow 4-5 percent in 2022, well below its average 6.7 percent from 2015-19. The key factors are continued credit problems in the country’s real estate sector, low-risk tolerance amongst lenders, and policy inertia as central bank authorities don’t want to ease too much ahead of the 20th Congress late next year (as top-level leaders have been calling for reducing credit expansion for years now). Certain commodities heavily dependent on Chinese demand like copper as well as China-linked currencies (AUD, NZD) could suffer as a result.

Disclaimer: BubbleCatcher is published as an information service for subscribers, and it includes opinions as to forecasts on the global economy and its impact on securities linked to economic activity. The publishers of BubbleCatcher are not brokers or investment advisers, and they do not provide investment advice or recommendations directed to any particular subscriber or in view of the particular circumstances of any particular person. BubbleCatcher does NOT receive compensation from any of the companies featured in our articles. At various times, the publisher of BubbleCatcher may own, buy or sell the securities discussed for purposes of investment or trading. BubbleCatcher and its publishers, owners, and agents are not liable for any losses or damages, monetary or otherwise, that result from the content of BubbleCatcher. Past results are not necessarily indicative of future performance. The information contained on BubbleCatcher is provided for general informational purposes as a convenience to the subscribers of BubbleCatcher. The materials are not a substitute for obtaining professional advice from a qualified person, firm, or corporation. Consult the appropriate professional advisor for more complete and current information. BubbleCatcher makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that BubbleCatcher endorses, sponsors, promotes, or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites unless expressly stated.