As a responsible long-term investor, there are certain issues beyond the day-to-day markets and economics that you just need to have a certain amount of knowledge about today in order to not get blind-sided if and when the market takes a turn. These issues include China and its relation to the U.S., the Federal Reserve and how / why central banks intervene in markets, cyberwarfare, and climate change, if only because these will likely be key themes for the next decade. The US-China story is a key theme that has become even more relevant today because of its impact on technology trends.

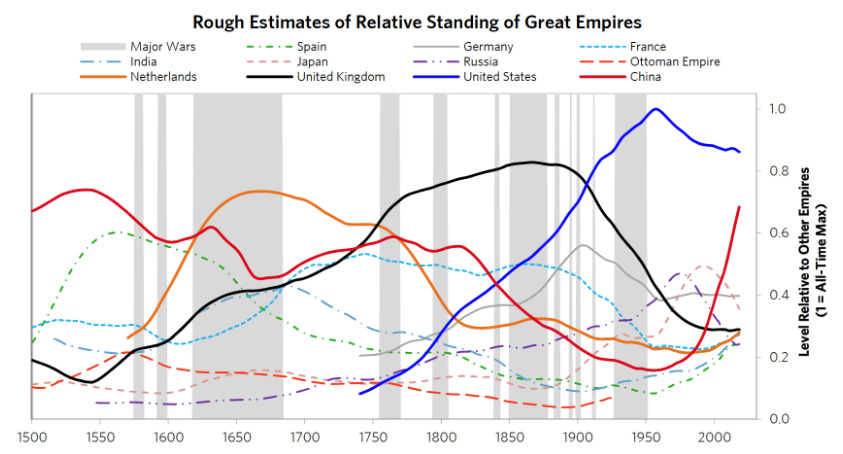

First, let’s get some context. Below is a chart made by hedge fund manager Ray Dalio and his team of researchers on the relative power of various world powers over the last 500 years. It is an ambitious undertaking to draw this but I think it’s extremely informative, even if some people may argue over its nuances. Each line reflects an aggregated index composed of various socioeconomic or political components that include economic output, education capabilities, military might, innovation and technology, trade efficiency, and reserve status of the currency.

source: “Principles”, by Ray Dalio; https://www.principles.com/the-changing-world-order/#chapter5

Some of the most notable trends we can see are that the U.S. reached its peak in the 1960s through 1980s and since then has been slowly falling relative to other nations. One might take issue with one or a few other trends in this chart though (i.e. Russia’s power in the 1950s and 1960s was probably a bit more than what was suggested in this chart; yes there were always problems in the economic system of the Soviet Empire but then again they did send a satellite and human being into orbit before the U.S.). But the overall picture is probably a generally accurate, rough geopolitical sketch of where the world is right now in relation to history. The U.S. is descending at a slow and gradual pace, and China is ascending quite quickly but still not up to America’s level, and most other economies are gradually moving upwards but at a slower pace.

The other notable aspect of this graph is just how quickly China’s power has ascended relative to other nations over the last 20 years. This is an ascendency not seen in history. The quickest pace we’ve seen perhaps is the Netherlands in the 1600s, who were able to harness their technological prowess in harnessing wind power to command sea lanes. China has been able to harness it’s massive 1.3 billion, highly motivated workforce to become a manufacturing powerhouse and lift itself out of the poverty that plagued the country for decades.

Below is another chart showing the relative powers of the major Chinese dynasties extending 800 years. While I am sure some experts in Chinese history might debate the nuances of these oscillations, the recent trend of China’s rapid ascendency during the reign of the Communist Party (CCP) is not arguable.

source: “Principles”, by Ray Dalio; https://www.principles.com/the-changing-world-order/#chapter5

This chart above is also informative in that it shows the relative timelines that Chinese leaders work with to enact policies. Whereas most U.S. presidents and political parties perceive themselves as leaders for four to eight years, today’s Chinese leaders view their term of power in 200-300 years if not longer. The most successful leaders built their power over time, with the end-goal of passing their power onto their heirs. Although the CCP is not a dynasty in the literal sense, it’s a helpful analogy because it gives you a sense of the timelines for their policies. Knowing they will stay in power for 100 years or more gives the CCP a huge incentive in investing in critical technological infrastructure that might not pay off for a decade or more.

The U.S., with its four-year leadership cycle and highly combative executive-legislative interparty tensions, doesn’t have this type of policy incentives in place. Not only will this hinder the U.S. in it’s technology development, but it will give China a huge advantage in preparing for another key investment trend for the future: climate change.

China has historically not tried to take on the U.S. in areas that the U.S. clearly dominated for decades, but this will change this decade. Previously what China has done is try to dominate areas that play to its competitive and strategic interests. For instance, China’s military is not as strong as the U.S. in areas of technological development or economic resources. But its military capabilities in the East and South China Seas are now believed to be more dominant than the U.S. Since China’s strategic interest is to eventually reclaim Taiwan, they see this region-specific dominance as critical to realizing their goals.

Moreover, the CCP views dominating key technology areas such as AI, big data, and semiconductors as a central economic development theme over the next decade. Unlike the U.S., the CCP will often set broad strategic objectives and then use indirect ways to ensure targets are met by the private sector. They will encourage private firms to shape corporate decisions around their priorities. Every major company has CCP leadership members within upper management that help shape this direction. This has its drawbacks (i.e. it could hamper innovation by diverting resources away from a firm’s natural competitive advantage). But it incentivizes companies to adopt policies and/or technology that matches the CCP’s goals. The CCP provides carrots such as low-interest loans, tax breaks, and other subsidies, and encourages Chinese companies to invest in foreign companies that have strategic technical know-how, such as foreign chip manufacturers with expensive IP.

China’s major tech conglomerates such as Huawei (the world’s largest telecom equipment maker) and ZTE are believed to benefit from these policies. Yes, this pisses off major trading partners because it is against WTO regulations, but China is now too big to start a fight with, so most partners have quietly dealt with it to maintain their trade status.

China’s government is also actively pushing companies to dominate 5G and even 6G development over the upcoming decade. China plans to activate over 130,000 5G base stations, helping it to develop the largest 5G network on earth. The U.S. is still playing catch-up. But the U.S. is legitimately concerned that Huawei technology could be used to spy on Americans (since the U.S. does so) and so placed Huawei on a trade blacklist to limit its use of American technologies. The U.S. government then restricted even non-U.S. manufacturers from building any products for Taiwan if they used American equipment. It finally forbade any suppliers that use American technology from selling to Huawei without a license.

As a result of these trends, the technology sector is likely to face significant headwinds. First, the survival of Huawei as a company is now at stake. But it’s not just Chinese companies that will get affected. China is going to have to respond with its own drastic moves towards U.S. companies since most trade wars follow a tit-for-tat strategy between competitors. This means any U.S. company with significant supply-chain exposure could be impacted in the coming weeks or months ahead. Key Nasdaq high-flyers like Apple will not be immune. Chinese companies are going to continue to innovate in areas around AI, computer vision, semiconductors, and consumer technology such as TicTok. They will do so with or without American help. But the encroaching cold war with U.S. technology companies will likely worsen in the coming years, particularly if Trump stays in power another four years. And this is on top of already existing geopolitical tensions in the U.S.-China relationship including America’s support for the Hong Kong protests (which China views as interference in their sovereign territory), the forced labor issues in Xinjiang, America’s disapproval over China’s Belt and Road Project, and China’s disapproval of America’s warming relationship with Taiwan, which also is perceived as China’s sovereignty.

This will make investing in Chinese tech companies tricky, but also in U.S. companies as they too will get affected by these trends, and this all will slow the pace of technology innovation in both countries for years if not decades to come. If Democratic leadership prevails in the U.S., it will still need tricky political maneuvering to help undo some of the damage already done by Trump.

So key takeaways? Always make sure to understand your investment’s exposure to China before taking the plunge. The U.S.-China trade relationship is a critical component of the U.S. economy, and understand these geopolitical tensions will be critical for any investor wanting to hedge their risks.

Disclaimer: BubbleCatcher is published as an information service for subscribers, and it includes opinions as to forecasts on the global economy and it’s impact on securities linked to economic activity. The publishers of BubbleCatcher are not brokers or investment advisers, and they do not provide investment advice or recommendations directed to any particular subscriber or in view of the particular circumstances of any particular person. BubbleCatcher does NOT receive compensation from any of the companies featured in our articles. At various times, the publisher of BubbleCatcher may own, buy or sell the securities discussed for purposes of investment or trading. BubbleCatcher and its publishers, owners and agents, are not liable for any losses or damages, monetary or otherwise, that result from the content of BubbleCatcher. Past results are not necessarily indicative of future performance. The information contained on BubbleCatcher is provided for general informational purposes, as a convenience to the subscribers of BubbleCatcher. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. BubbleCatcher makes no representations or warranties about the accuracy or completeness of the information contained on this web site. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that BubbleCatcher endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated.